INFORMATION ON WITHHOLDING

Turkish tax laws do not only adopt the declaration method, but also the method of deduction at the origin. The laws charge those who are obliged to make a tax withholding, with the duty to collect in advance and to pay the tax before making to the beneiciaries the payments that are clearly speciied by laws, to the tax office. The tax deduction made during the payment is called the Withholding Tax or Stoppage Tax.

All the transactions under this practice are performed between the withholder and the beneiciary. During withholding, the real and legal entities who make payment to the beneiciary pay the net amount remaining after having made the tax withholding to the beneiciary and they inform the relevant tax office with a withholding tax return within the time periods specified in the law of the incomes subjected to withholding and the amount of withholding they have made on such incomes.

In the case that these incomes are subjected to tax return, the taxes withheld by those who made the payment on behalf of those who made these incomes, may be set of against the tax calculated on the annual return. In cases where the income on which a withholding is levied is not declared, the tax paid by withholding becomes the final tax.

1. WITHHOLDING RATES

On the withholding tax return, the withholding tax is withheld from the payments made to the self-employed, most frequently in wage and salary payments, rent payments, and interest and dividend payments.

According to the main headings, the withholding rates are as follows:

– 15% in dividend payments

– 20% of the gross rent price in the rent payments made to real persons

– 20% in the payments made to the self-employed (CPA, Attorney, MDs, and etc.)

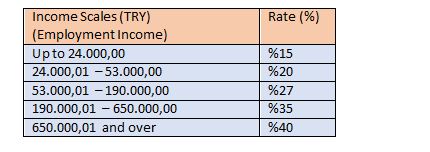

– Wage Income Tax Withholding Rates for the year 2019 are as follows:

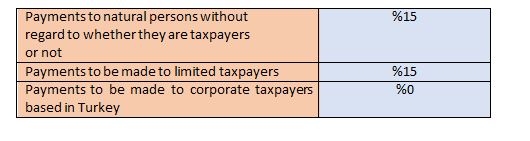

Tax Over Internet Advertisement Service: By virtue of the Presidential Decision no. 476 as published in the Oicial Gazette (issued on 19 December 2018 under no. 30630), from 1/1/2019, in connection with Internet (online) advertisement services, advertisement service providers or those who act as intermediaries in Internet advertisement services shall be subject to withholding taxes at the following rates: